Bourron-Marlotte Chronicles

Exploring the beauty, culture, and stories of Bourron-Marlotte.

Why Your Landlord's Insurance Isn’t Your Safety Net

Discover why relying on your landlord's insurance could leave you exposed. Protect yourself with the right coverage today!

Understanding the Limits of Your Landlord's Insurance Policy

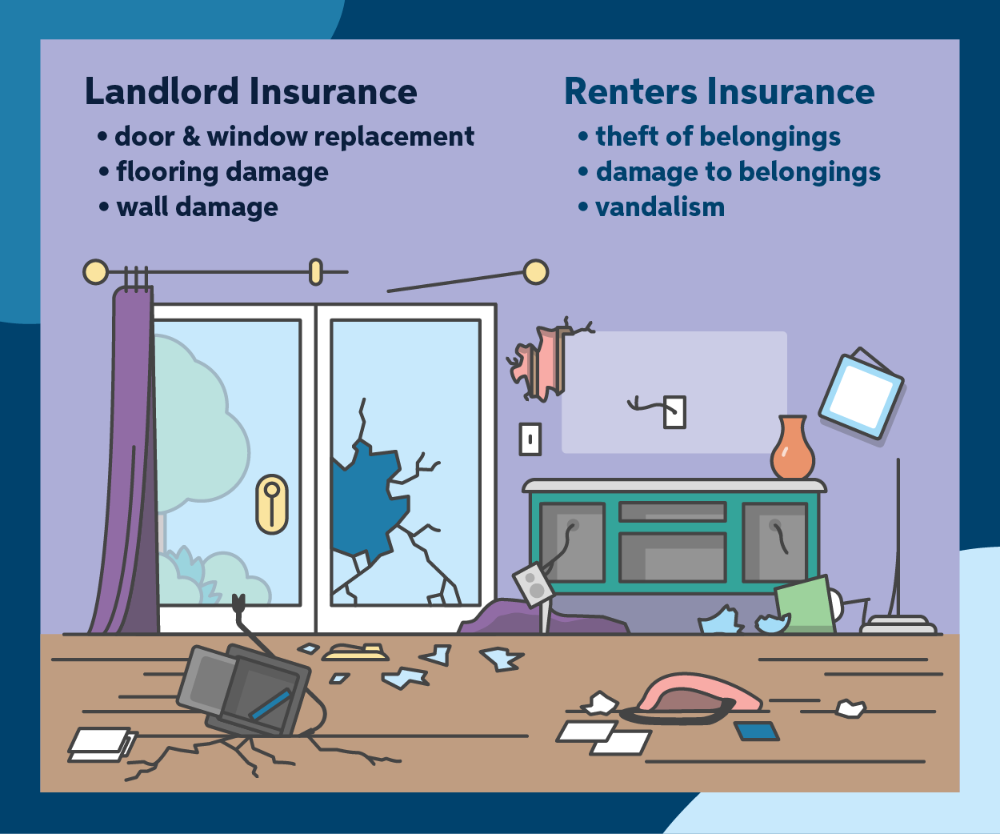

When renting a property, it's crucial to understand the limits of your landlord's insurance policy. Typically, this type of insurance covers the building structure and any fixtures, but it does not extend to the personal belongings of tenants. If a disaster strikes, such as a fire or flood, your landlord's policy may only cover the cost to repair and replace the property itself. To protect your personal assets, consider investing in renter’s insurance, which can fill the gaps left by the landlord’s coverage.

Another important aspect to consider is the liability coverage provided under your landlord's insurance. This policy may protect the landlord from claims related to injuries sustained on the property, but it doesn't necessarily cover you as a tenant. For example, if a guest is injured in your rented space, your landlord's policy may not offer you any assistance in medical expenses or legal fees. Thus, understanding the limits of your landlord's insurance policy is essential for ensuring that you have adequate coverage for your own needs as a tenant.

What You Need to Know About Tenant Protection Beyond Landlord Insurance

When it comes to tenant protection, many renters mistakenly rely solely on landlord insurance to shield them from potential risks. While landlord insurance primarily covers the property owner's liabilities, tenants need to consider additional layers of protection for their belongings and rental experiences. For instance, personal renter's insurance can provide coverage for personal items in the event of theft, fire, or natural disasters. It’s crucial for tenants to understand that their possessions are not protected under a landlord's policy, making individual coverage a vital aspect of their overall security.

Beyond standard renter's insurance, tenants should also be aware of their rights and local laws concerning tenant protection. Many states offer legal protections against unjust evictions, discrimination, and unsafe living conditions. Familiarizing oneself with tenant rights can greatly enhance a renter's confidence and ability to advocate for their needs. Additionally, joining local tenant unions or advocacy groups can provide essential support and resources to help navigate potential disputes with landlords. Ultimately, understanding these aspects of tenant protection empowers renters to make informed decisions and safeguard their interests in a rental property.

Is Your Landlord's Insurance Enough? Exploring Tenant Safety Nets

When considering whether your landlord's insurance is sufficient, it's important to understand the differences between landlord policies and tenant protections. While a landlord's insurance policy typically covers the building structure and liability for injuries occurring on the property, it may not cover personal belongings or provide adequate protection for tenants in the event of unforeseen disasters such as fire or flooding. Therefore, tenants should assess their potential risks and explore additional safety nets, such as renter's insurance, which can safeguard their personal property and offer liability coverage.

Moreover, tenants should also inquire about any additional safety measures that may be in place to protect them. Features such as smoke detectors, security systems, and regular maintenance checks can significantly impact tenant safety. Creating an open line of communication with your landlord about these elements not only ensures that you are informed but also fosters a sense of security in your living environment. Ultimately, evaluating your landlord's insurance and understanding your own coverage needs is essential for ensuring both tenant safety and peace of mind.