Bourron-Marlotte Chronicles

Exploring the beauty, culture, and stories of Bourron-Marlotte.

Crypto Regulation: The Dance Between Decentralization and Government Oversight

Explore the tug-of-war between blockchain freedom and government control—discover how crypto regulations shape our financial future!

Understanding Crypto Regulation: How Governments Are Shaping the Future of Decentralized Finance

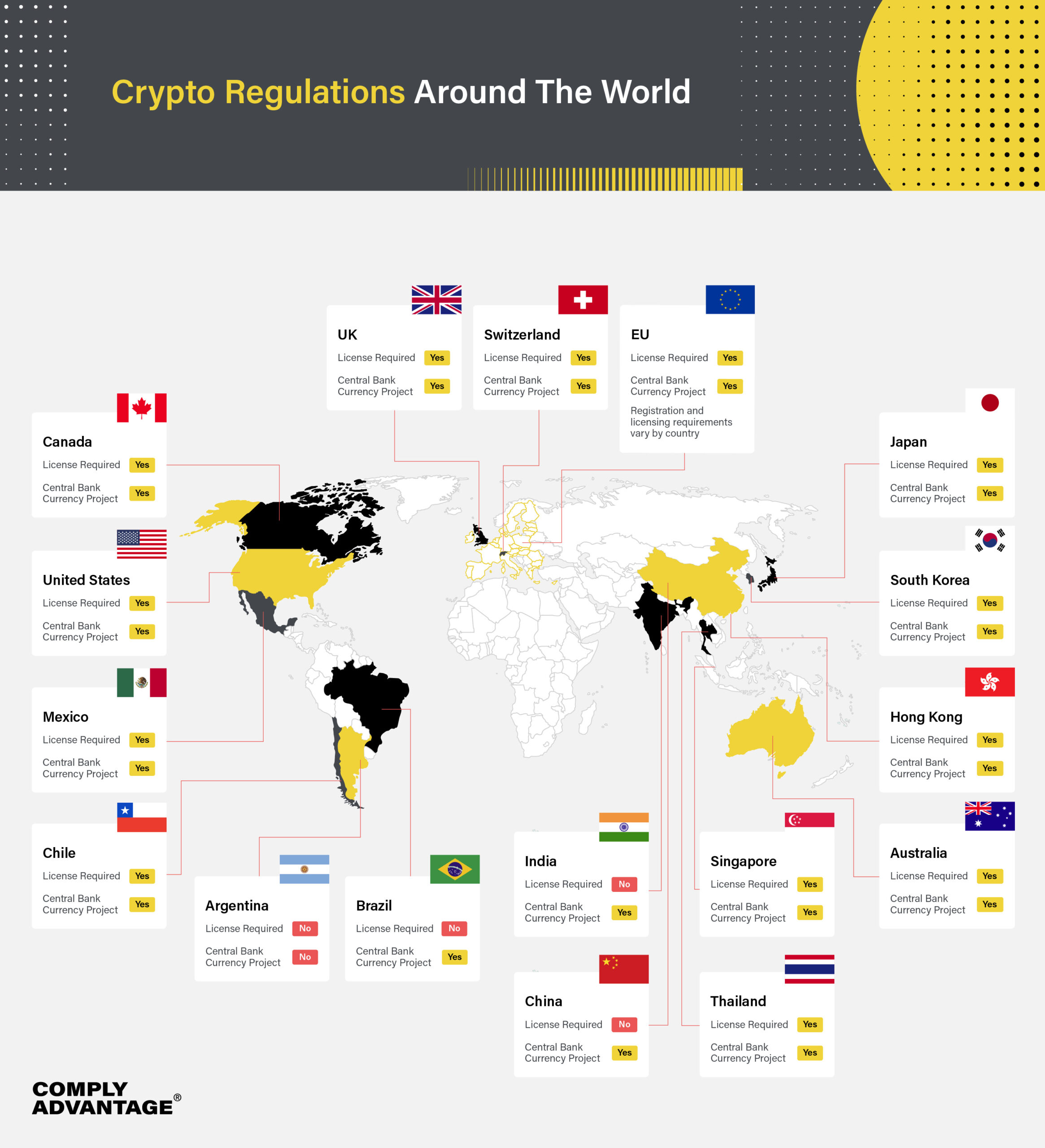

The evolution of crypto regulation has become a pivotal topic as decentralized finance (DeFi) continues to gain traction in the global market. Governments across the world are grappling with how to implement rules that can address the unique challenges and opportunities posed by cryptocurrencies and blockchain technology. From the European Union's MiCA (Markets in Crypto-Assets) regulation to the U.S. SEC's ongoing efforts to define and enforce securities laws, the regulatory landscape is rapidly changing. These regulations aim not only to protect consumers but also to foster innovation within the financial sector, leading to a more structured integration of decentralized finance into mainstream economics.

As nations strive for a balanced approach, the implications of these regulatory frameworks are significant. They can affect everything from crypto exchanges and initial coin offerings (ICOs) to the everyday transactions of blockchain users. By creating clear guidelines, governments seek to mitigate risks such as fraud, money laundering, and market manipulation, while encouraging technological growth. As a result, stakeholders within the crypto space—ranging from developers to investors—must remain vigilant and adaptable to stay compliant. Understanding the interplay between regulation and innovation in decentralized finance is crucial for navigating the future of this industry.

Counter-Strike is a popular team-based first-person shooter game that has captivated players since its release. The game emphasizes teamwork, strategy, and skill, making every match unique. For those looking to enhance their gaming experience, using a betpanda promo code can provide great benefits. With various game modes and maps, Counter-Strike continues to be a favorite in the gaming community.

Decentralization vs. Regulation: What Does the Future Hold for Cryptocurrency?

The ongoing debate between decentralization and regulation in the cryptocurrency space is one of the most critical issues shaping its future. As blockchain technology evolves, it offers unparalleled opportunities for financial freedom, but the absence of regulation raises concerns about security, fraud, and market volatility. Proponents of decentralization argue that it allows for a more democratic financial system, where individuals have complete control over their assets without governmental interference. However, critics assert that without regulatory frameworks, the risk of scams and market manipulation increases significantly, creating a volatile environment that could deter mainstream adoption.

Looking forward, the relationship between decentralization and regulation will likely evolve into a hybrid model. As governments worldwide begin to recognize the potential of cryptocurrency, we may see regulatory measures designed to protect consumers while still preserving the core principles of decentralization. This could lead to a balanced approach where innovations in blockchain technology flourish alongside a well-regulated ecosystem that provides stability and confidence to investors. The future of cryptocurrency will undoubtedly depend on finding this balance, making it essential for stakeholders to engage in ongoing dialogues about the best path forward.

Are We Ready for a Global Crypto Regulation Framework? Exploring the Impacts

The rise of cryptocurrencies has sparked a debate about the need for a global crypto regulation framework. As digital currencies gain popularity and adoption across various sectors, governments and regulatory bodies are recognizing the necessity of establishing clear guidelines to address issues such as fraud, taxation, and consumer protection. The lack of uniform regulations creates a fragmented landscape, where differing laws in countries can lead to confusion and potential exploitation. Are we ready for comprehensive regulations that require international cooperation? The answer lies in understanding both the benefits and drawbacks of such regulations.

Implementing a global crypto regulation framework could have profound impacts on the cryptocurrency market. On one hand, it may provide much-needed legitimacy and security, encouraging mainstream adoption among investors and businesses. On the other hand, many fear that excessive regulation could stifle innovation and drive crypto activities underground. To strike a balance, stakeholders must engage in open dialogue, weighing the necessity for regulation against the need for a vibrant industry. In this context, the question remains: Are we ready to embrace a future where crypto operates under a unified regulatory umbrella?